Protect your customers from fraud – with our data

Fraud schemes involving transfers to fraudulent IBANs are on the rise. As a service provider, you process numerous IBAN requests – whether through direct user input or by analyzing existing data sources. Our API helps you detect suspicious IBANs early and actively prevent fraud.

Who is our API for?

Our API provides protection for companies that regularly process IBANs, including:

- Accounting software – as a service for clients

- Invoice approval tools – to prevent fraudulent payments

- Credit rating agencies – to enhance credit reports with fraud indicators

- Software for legal guardians – to review payment flows

- Debt counselors & collection agencies – to identify suspicious recipients

- LegalTech companies – to detect new fraud cases

IBAN checks for your customers – in real time or retroactively

Do your customers need to instantly verify an IBAN before making a payment? Or do you want to analyze past transactions to detect suspicious IBANs?

Then we’re the right partner for you.

What our API offers:

√ Real-time alerts for suspicious IBANs

√ Easy integration into your existing systems

√ Maximum data privacy – IBANs are stored only on your local systems

What our API does not offer:

x Detailed information about specific IBANs

x Permission to share the data – neither manually nor automatically

x Functions of a payment institution or payment initiation service under the German ZAG

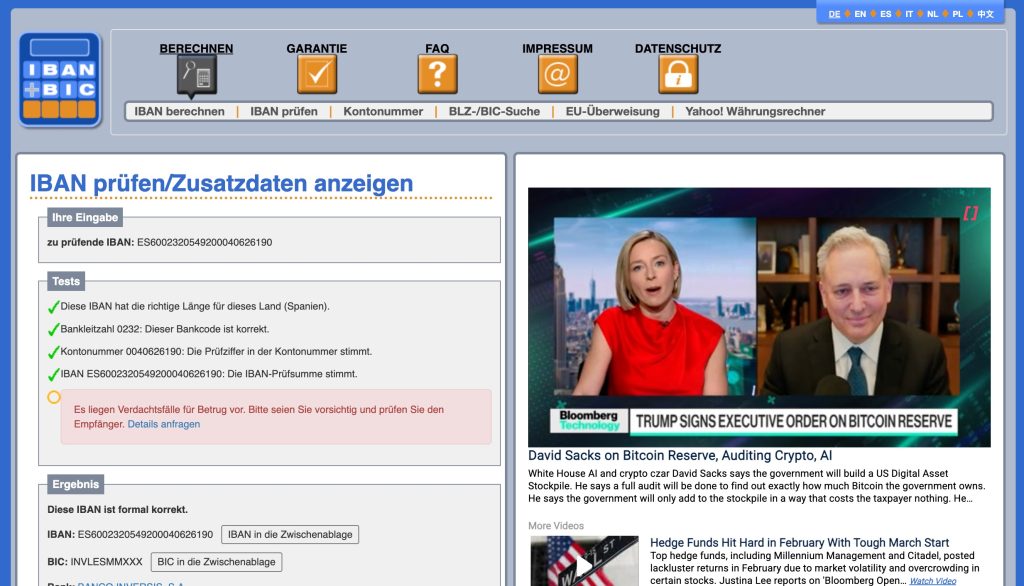

Real-world example: IBAN-Calculator.com leading the way in security

A great example of our API in action is IBAN-Calculator.com. For over two years, the platform has used our IBAN feed to provide important warnings to users – directly during IBAN validation.

If a suspicious case is detected, the following warning appears:

“This IBAN has been linked to suspected fraud. Please proceed with caution and verify the recipient.”

More information about IBAN validation on IBAN-Calculator.com can be found here:

Request API access now!

Would you like to offer your users better protection and integrate our fraud detection into your systems? Contact us today and discover how our API can make your services more secure.

➡ Learn more & request access: Get in touch