Fraud prevention for banks – Use our IBAN warnings to protect your customers

Since December 18, 2024, the FinanzGuru app has actively protected over one million users from fraudulent payments. By integrating our continuously updated IBAN warning list in the backend, the app detects suspicious payees and alerts users.

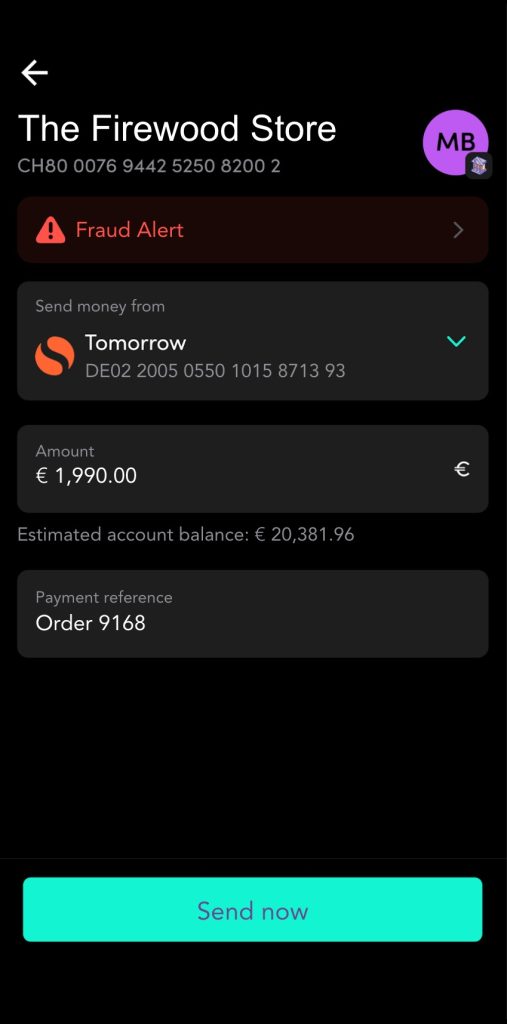

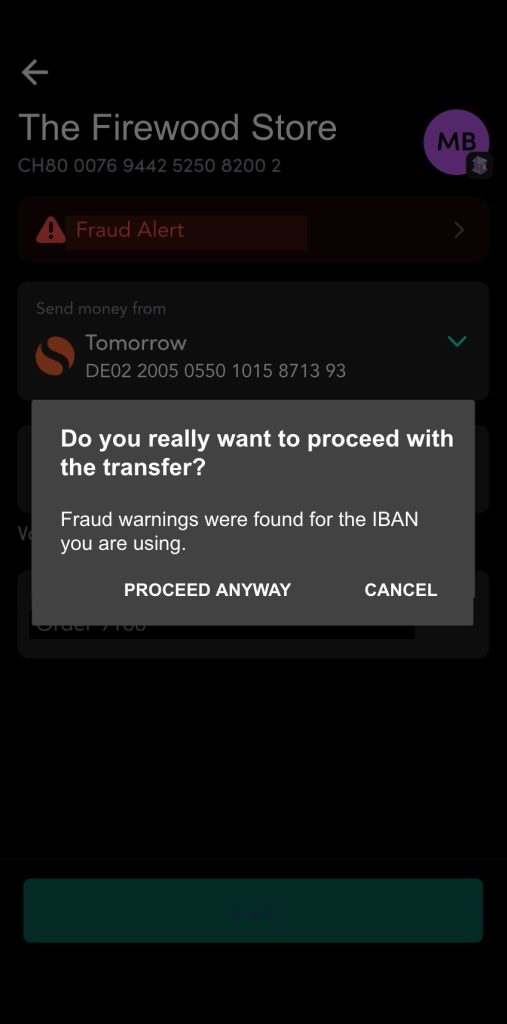

This is what it looks like in practice:

The result? If an IBAN is flagged, the user receives a warning. They can still complete the transfer, but in most cases, they cancel it – and are grateful for the alert.

Benefits for banks

- No additional effort for the operations team

- No extra documentation required to meet compliance

- No liability risks from blocking transactions

How effective is the system?

If the FinanzGuru app had used our IBAN warnings in 2023, and users had transferred through it, 38% of fraud cases could have been prevented.

This is the core of #WarnToPrevent: Preventing damage before it happens.

How can banks and partners benefit?

We invite you to test our data yourself – and to pass this value on to your partners. Three questions are key:

- How often did affected customers send money to flagged IBANs?

- In how many cases was the transaction made after our report – meaning a warning could have been triggered?

- Would using our IBAN list have paid off?

Our data not only helps protect your customers but also allows you to detect potential risks earlier.

Request access now!

Integrate our fraud detection into your system – for added protection with no extra work for your team.

➡ Get in touch & learn more

Since 2019, we’ve been sending proactive fraud alerts to banks via email. Want to receive our warnings too? Simply register with your business email using the form below. We look forward to supporting your fraud prevention efforts.